QUICK

|

PRODUCT

|

LOANSIFTER PARTNER

|

Home equity searches are now available in the PPE, and they’re customizable — allowing you to filter by lien position and loan type, including:

Search across 25+ investors that support home equity in the solution you’re already familiar with.

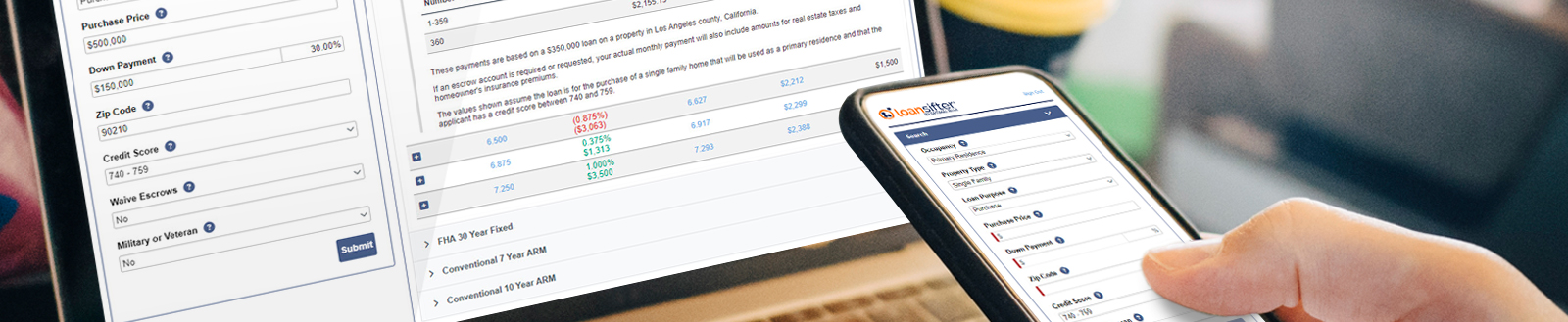

Ready to see why the Loansifter PPE engine has been the #1 choice for brokers for over a decade? Explore the user-centric interface and see how mortgage brokers just like you easily access rates from more than 120 investors each day.

Optimal Blue, LLC its affiliates and subsidiaries (the "Company") provides equal employment opportunities (EEO) to all employees and applicants for employment without regard to race, color, religion, creed, pregnancy (childbirth & related conditions), gender, gender identity & expression, sexual orientation, national origin to include ancestry, age, disability (mental or physical), marital status, military or veteran status, or genetics. In addition to federal law requirements, the Company complies with applicable state and local laws governing nondiscrimination in employment in every location in which the company has facilities. This policy applies to all terms and conditions of employment, including, but not limited to, hiring, placement, promotion, termination, layoff, recall, transfer, leaves of absence, compensation, and training. Optimal Blue participates in the E-Verify program.